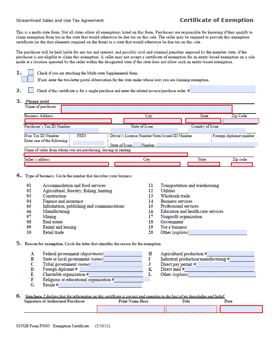

ct sales tax exemption form

44 rows Form Inst. Exemption from sales tax for services rendered between parent companies and wholly-owned subsidiaries.

Admissions and Dues Taxes Form.

. Sales of goods and services to Connecticut credit unions beginning July 1 2016 12-412 121 MOTOR VEHICLES AIRCRAFT AND BOATS. Digital or physical certificate will be mailed to your address. For other Connecticut sales tax exemption certificates go here.

Filing Timely Returns Amending a Sales and Use Tax Return Renewal of Your Sales Tax Permit Sales Tax Relief for Sellers of Meals Exemptions from Sales and Use Taxes. Ad Fill out a simple online application now. Completing Fill-in Forms We are providing a fill-in function for some of our forms.

- Click here for updated information. Online Filing - All sales tax returns must be filed and paid electronically. Exemption from sales tax for items purchased with federal food stamp coupons.

That are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i Sales of goods and services to Connecticut credit unions beginning July 1 2016 12-412 121 MOTOR VEHICLES AIRCRAFT AND BOATS Flyable aircraft 12-412 20 Boats docked in the state for 60 days or fewer 12-408 1 E ii. In order to qualify for the sales tax exemption a farmer must first apply with the Department of Revenue Service DRS by filing Form REG 8. - Click here for Income tax filing information.

Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. You can download a PDF of the Connecticut General Sales Tax Exemption Certificate Form CERT-100-B on this page. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

Sales tax exemption forms as well as business sales tax id applications sales tax returns and the full Connecticut sales tax code can be downloaded from the Connecticut Department of Revenue. The form must be forwarded to Taxpayer Services at DRS for review. Sales and Use Tax Exemption for Purchases by Qualifying Governmental Agencies.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Applicable to certain services prior to June 30 1987. Launch the Acrobat Reader.

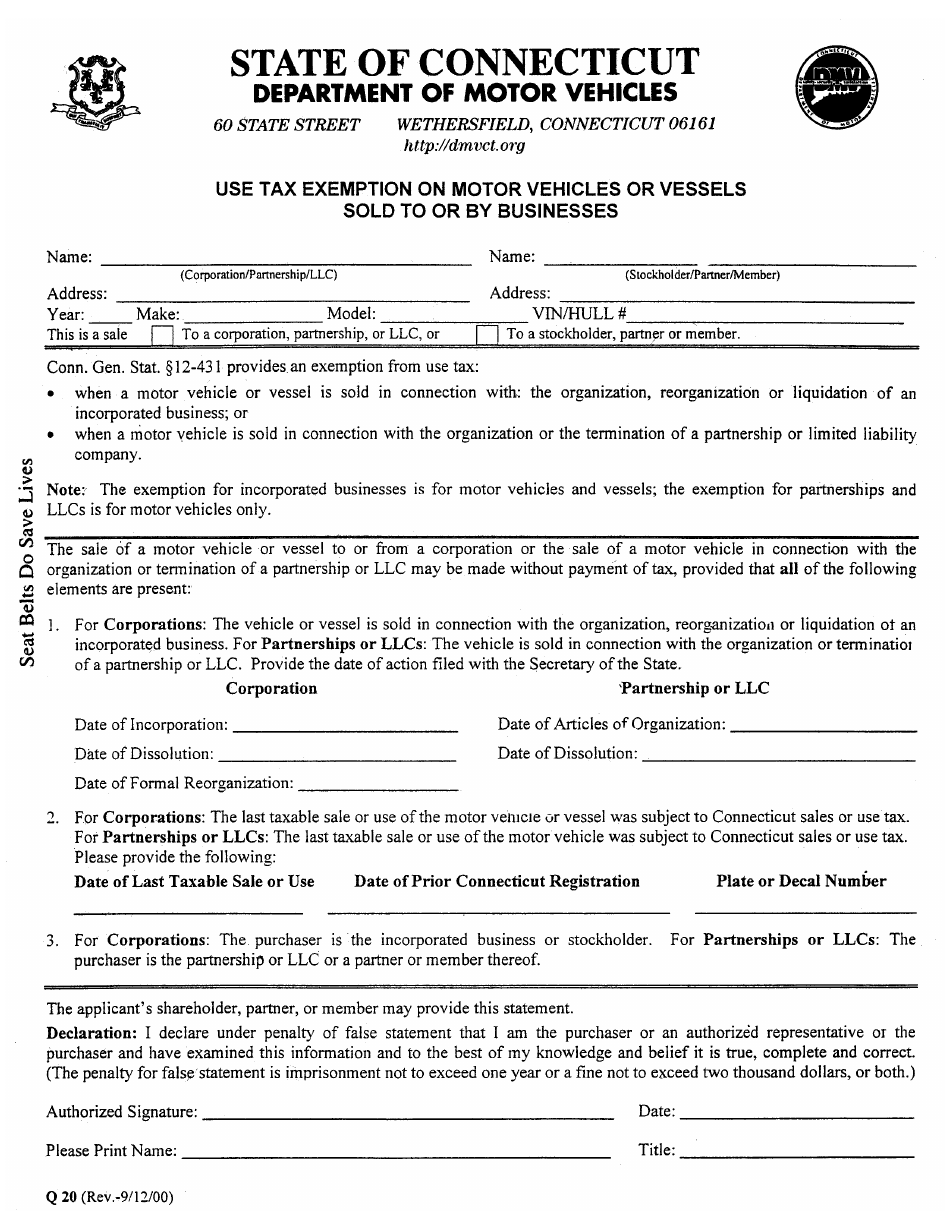

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Connecticut. 12-41260 Motor vehicles sold to limited liability companies or their members in connection with the organization or termination of the limited liability company provided the last taxable sale was subject to tax.

Health Care Provider User Fees. Factors determining effective date thereof. If approved form OR-248 Agricultural Sales Tax Exemption Permit is issued.

The Forms Professionals Trust. Please visit the Filing and State Tax section of our website for more information on this process. To obtain a Connecticut sales tax exemption certificate Form CERT-119 for a purchase other than meals and lodging contact the Tax Department 203-432-5530.

Sales tax relief for sellers of meals. Reduced Sales and Use Tax Rate for Motor Vehicles Purchased by Nonresident Military Personnel and their Spouses. Sales Tax Exemptions in Connecticut.

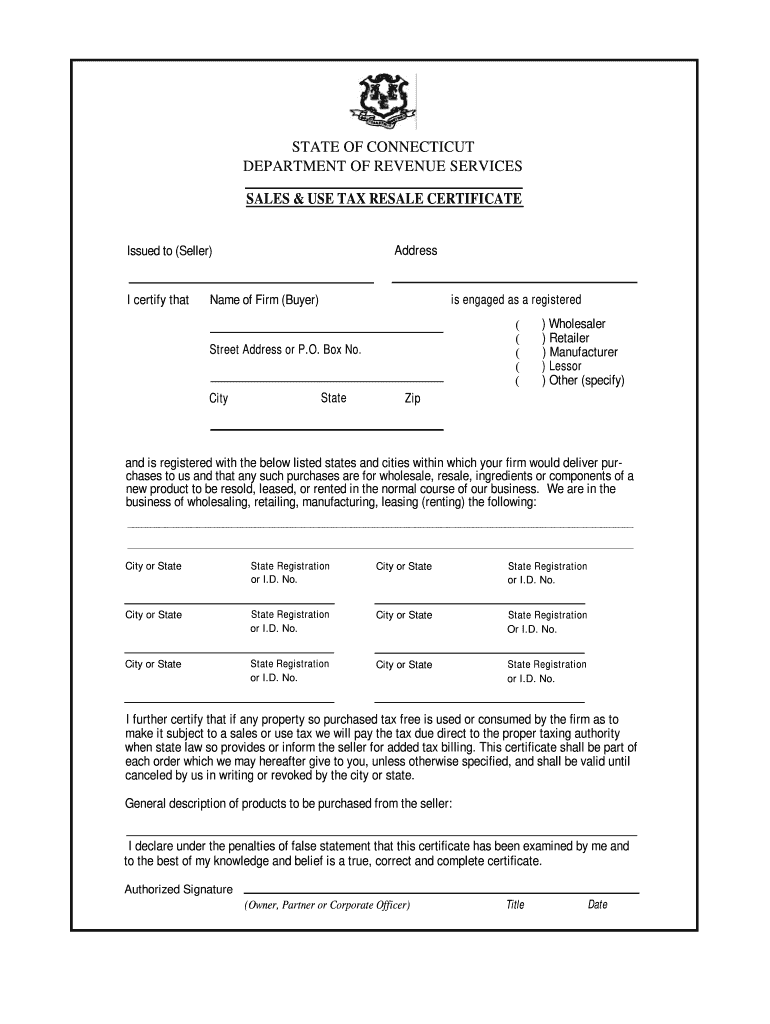

Connecticut Civil Procedure - Exemptions - Requests. I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority when state law so provides or inform the seller for added tax billing. The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn.

You can download a PDF of the Connecticut Resale Exemption Certificate Form CERT-100 on this page. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Business Use Tax Returns.

Do Connecticut sales tax exemption certificates expire. You can download a PDF of the Connecticut General Sales Tax Exemption Certificate Form CERT-100-B on this page. The application is then either approved or denied.

This will allow you to enter information directly on the form and print the form with the information you entered. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax.

Exemption from sales tax for items purchased with federal food. This certificate shall be part of. Sales tax relief for sellers of meals.

Several exemptions are certain types of safety gear some types of groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent light bulbs most types of medical. Taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer. Connecticut Effective January 1 2017 your sales tax permit expires every 2 years but there is no cost to renew if.

Electronic filing is free simple secure and accessible from the comfort of your own home. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly click here to learn more. Sales and Use Tax Forms.

Purchases of Items by Eleemosynary Organizations and Schools That Will be Resold Tax. Rental Surcharge Annual Report. Sales and Use Tax Returns.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Connecticut State Department of Revenue Services. Other Sales and Use Tax Forms.

Materials tools fuels machinery and equipment used in manufacturing that are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i. In Acrobat Reader select the File menu then select Open then select the form you had just saved. For other Connecticut sales tax exemption certificates go here.

Connecticut no longer issues exemption permits but accepts for proof of exemption a copy of the Federal Determination Letter or a Connecticut. - Click here for updated information. Dry Cleaning Establishment Form.

An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of the exemption from sales and use taxes. On making an exempt purchase Exemption Certificate holders may submit a completed Connecticut Sales Tax Exemption Form to the vendor instead of paying sales tax.

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

Credit Applications Tarantin Industries

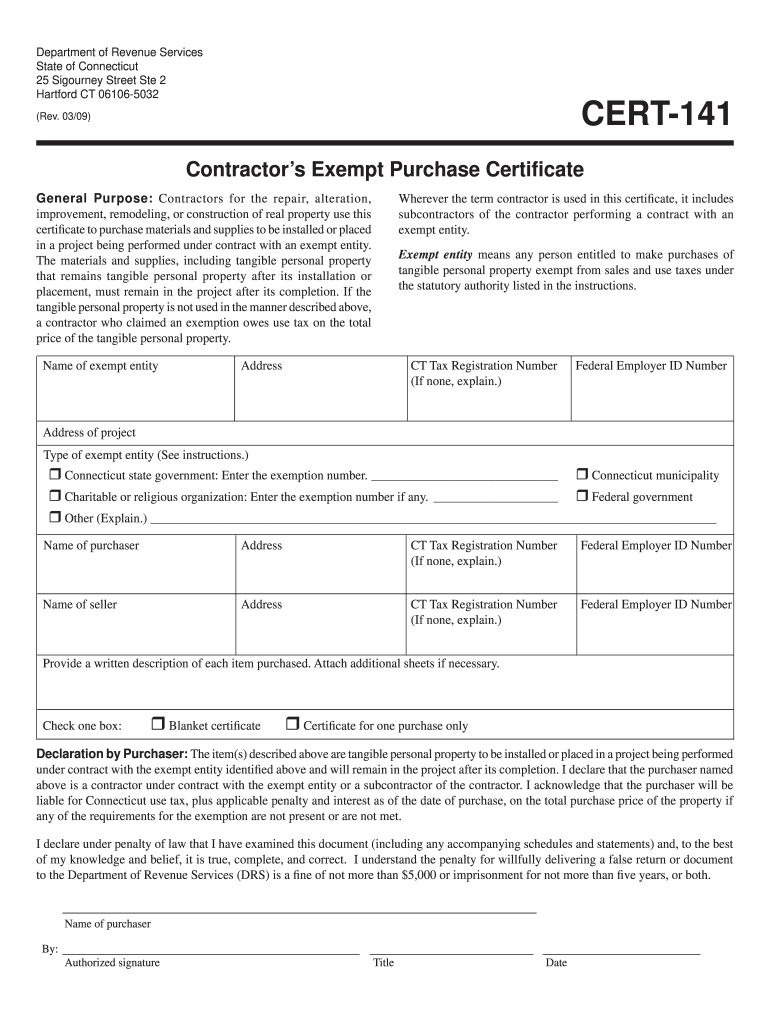

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

Form Reg 8 Fillable Farmer Tax Exemption Permit

Form Q 20 Download Fillable Pdf Or Fill Online Use Tax Exemption On Motor Vehicles Or Vessels Sold To Or By Businesses Connecticut Templateroller

Form Ct 205 Fillable Cigarette Tax Reconciliation Form File Online Using Tap

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

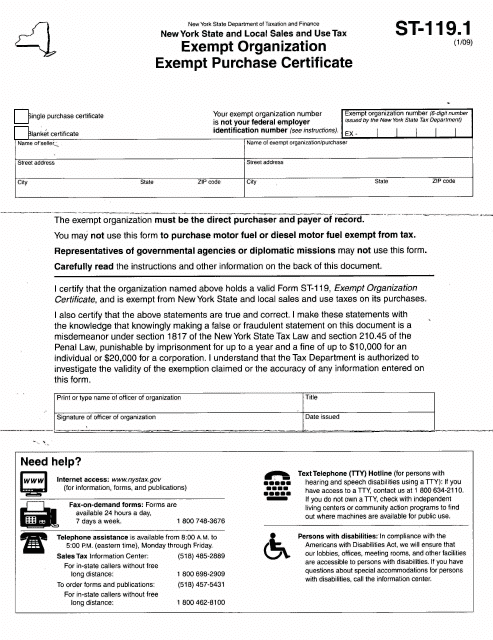

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Credit Applications Tarantin Industries

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

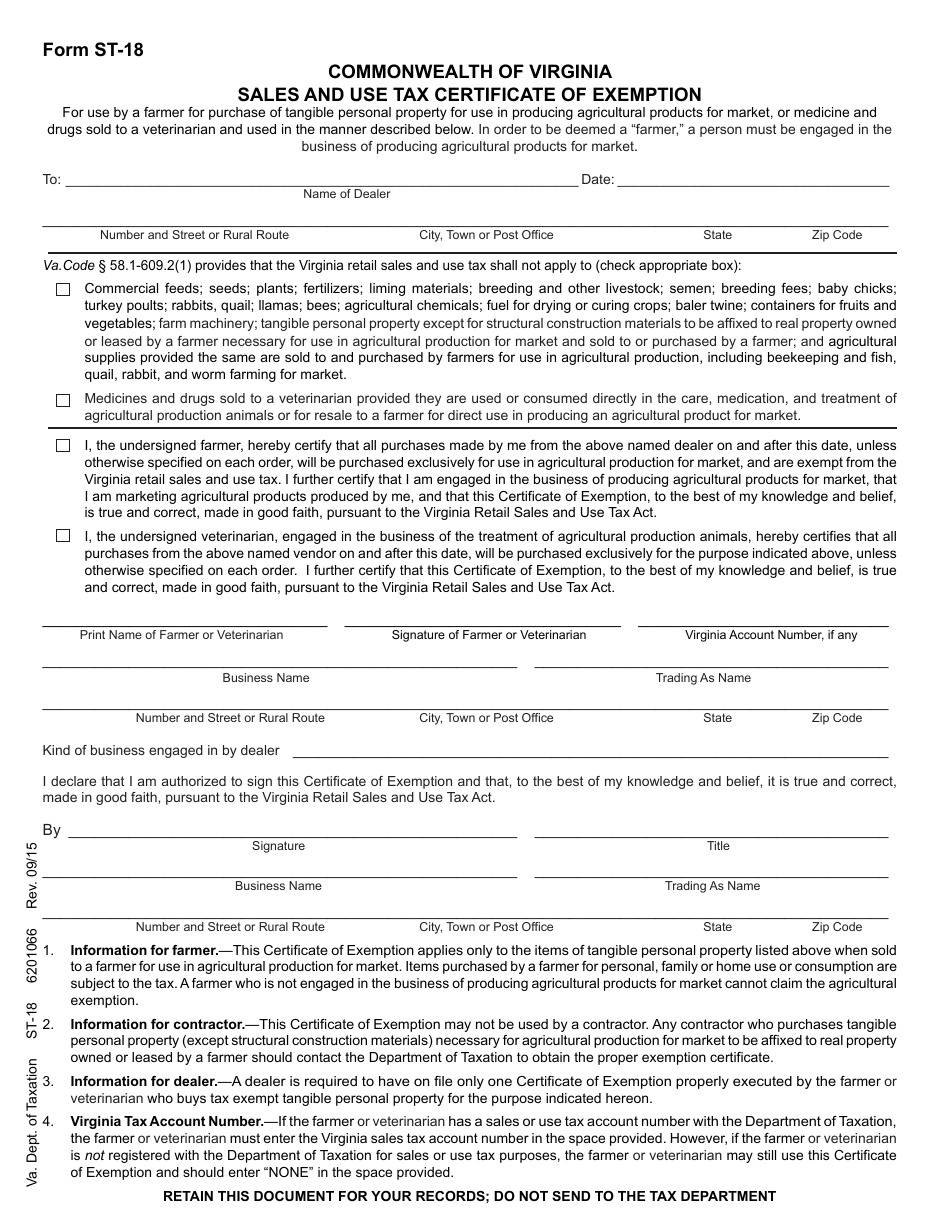

Form St 18 Download Fillable Pdf Or Fill Online Sales And Use Tax Certificate Of Exemption Virginia Templateroller

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

Businessusetaxexemptform Motion Raceworks